Purchase and install qualifying windows or patio doors that meet energy star windows program version 6 0 performance requirements beginning january 1 2018 through december 31 2020 save your sales receipt a copy of the manufacturer s certification statement and product performance nfrc ratings energy star qualification sheet with your.

Energy saving windows tax credit 2018.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

More on saving energy.

Non business energy property credit.

Upgrading to energy efficient windows skylights or exterior doors.

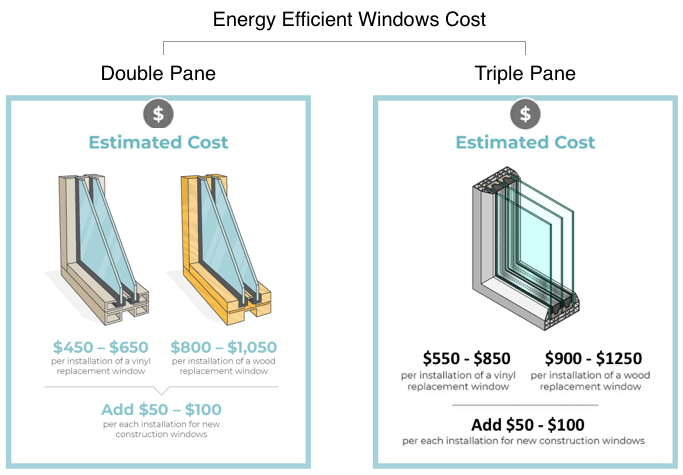

Does not include installation.

If nonbusiness energy property credits are renewed for 2018 and unchanged from 2017 they could be available for certain improvements to energy efficiency.

This tax credit has unfortunately expired but you can still claim it for tax years prior to 2018 if you haven t filed yet or if you go back and amend a previous year s tax return.

Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year.

Claim the credits by filing form 5695 with your tax return.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Windows doors and skylights.

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year.

Federal income tax credits and other incentives for energy efficiency.

Adding insulation specifically to reduce heat loss or gain.

Does not include installation.

The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

In 2018 and 2019 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows.

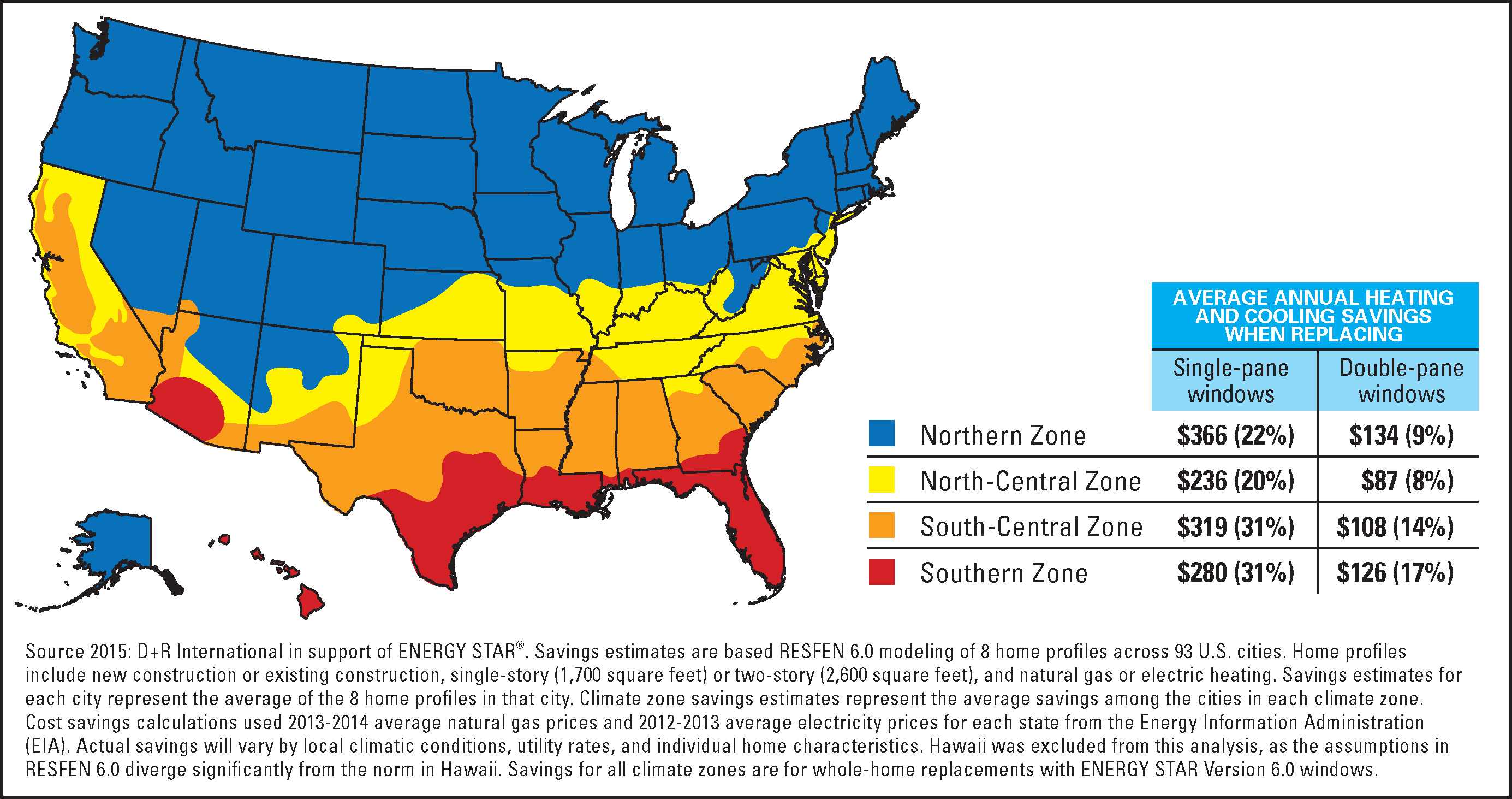

Windows doors and skylights that earn the energy star save energy improve comfort and help protect the environment.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

10 of the cost up to 500 but windows are capped at 200.

Here are some key facts to know about home energy tax credits.

Not including installation requirements must be energy star certified.

The tax credits for residential renewable energy products are still available through december 31 2021.

You do not have to replace all the windows doors skylights in your home to.

10 percent of the cost up to 200 for windows and skylights and up to 500 for doors.